Introduction

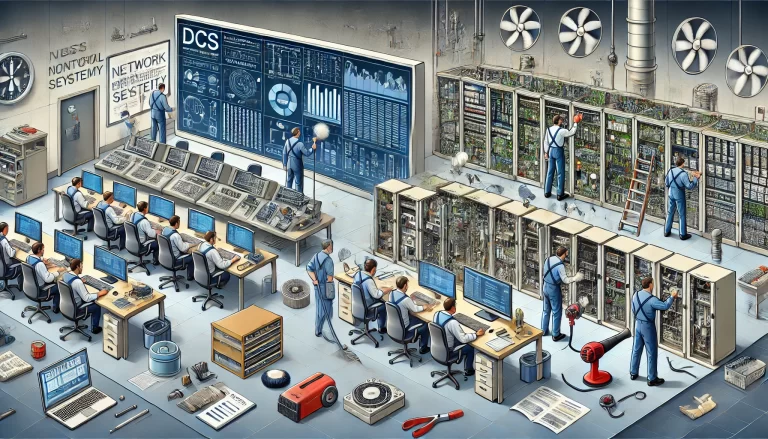

In recent years, the inspection cycle of Safety Instrumented Systems (SIS) and Distributed Control Systems (DCS) has become a focal point of discussion in China’s chemical industry. Unlike general industrial equipment maintenance, the periodic inspection of SIS and DCS is directly linked to a plant’s automatic protection and regulation capabilities—especially critical in high-risk environments involving flammable, explosive, or toxic substances.

However, overly frequent inspections may introduce new operational risks due to system intervention, while overly extended cycles may lead to the accumulation of hidden hazards. Thus, setting an appropriate inspection cycle is not just a technical decision but a strategic challenge in safety management.

1. Regulatory Guidelines and Standard Gaps

Currently, China lacks unified national standards that clearly define mandatory inspection cycles for SIS and DCS systems. However, practical guidelines exist across various industries. For example:

The 2019 edition of the Petrochemical Equipment Maintenance and Inspection Code suggests that for high-risk processes (e.g., risk level 3 and above, or units involving major hazards), the DCS inspection cycle should align with plant overhauls—typically every 3 to 4 years.

For lower-risk units, the cycle may be extended to cover two major overhauls (6–8 years).

This reflects a risk-based approach: more frequent inspections for high-hazard systems and more flexible intervals for less critical equipment.

2. Evolving Safety Landscape in China’s Chemical Industry

The importance of safety in chemical production has grown significantly. With the implementation of laws such as the Work Safety Law of the People’s Republic of China, companies face stricter inspection and reporting obligations.

For instance:

The Tangshan Emergency Management Bureau handbook recommends that basic process control systems be inspected at least once every 6 years, ideally aligned with planned shutdowns.

Though these are not legally binding, they provide strong operational guidance and reflect growing regulatory expectations at the local level.

3. Regional Environmental Variability and Its Impact

China’s vast geography leads to significant environmental differences that directly impact equipment health and inspection requirements.

🔹 Coastal Regions

High humidity and salt-laden air cause accelerated corrosion. For instance, DCS terminal strips in coastal refineries may corrode visibly within 3 years.

Recommendation: Use a “base cycle + environmental correction factor” to adjust inspection frequency based on corrosion risk.

🔹 Inland Regions

Drier climates (e.g., Northwest China) face less corrosion but experience extreme heat or temperature fluctuations.

In a Xinjiang coal chemical plant, DCS cabinets suffered thermal failure due to aged cooling fans not being replaced within a 4-year inspection cycle.

Thus, climate-specific adjustments are essential, whether to account for salt corrosion, dust, or thermal degradation.

4. Role of Technology in Dynamic Inspection Strategies

With the rise of Industrial IoT and predictive maintenance, many chemical companies are moving away from fixed-interval inspections.

✅ Benefits of Intelligent Monitoring:

Real-time system diagnostics reduce reliance on scheduled human inspections.

Predictive analytics help identify failure precursors early, enabling timely, targeted intervention.

For example, by integrating smart sensors and analytics platforms into DCS systems, maintenance teams can detect abnormal power consumption or signal drift before the issue escalates—transforming maintenance from reactive to proactive.

5. Practical Insights from Enterprises

Despite industry norms, companies should tailor inspection strategies based on plant-specific realities.

🔸 Large Petrochemical Enterprises:

Operate continuously under high loads with minimal downtime.

Implement modular inspection plans for different units, prioritizing risk-critical systems with shorter inspection cycles.

🔸 Small and Medium Chemical Enterprises:

May adopt longer inspection intervals for cost efficiency.

However, they must maintain a “safety baseline”—ensuring that essential inspections for SIS and DCS systems are never omitted, especially in hazardous areas.

A risk-based, criticality-driven classification of devices (e.g., life-safety vs. auxiliary control) allows firms to prioritize maintenance resources more efficiently.

Conclusion and Recommendations

In China’s chemical sector, there is no one-size-fits-all approach to SIS and DCS inspection cycles. However, companies can adopt the following strategy framework:

Align inspection with shutdowns (typically every 3–4 years) for critical systems.

Adapt cycles by region using environmental risk factors.

Leverage smart monitoring tools to enable dynamic, condition-based maintenance.

Classify equipment by risk level, and apply differentiated inspection strategies.

Refer to local government manuals (e.g., Tangshan Safety Handbook) as supplemental guidance.

A well-planned and diligently executed inspection cycle doesn’t just meet compliance—it lays a solid foundation for long-term operational safety and reliability.